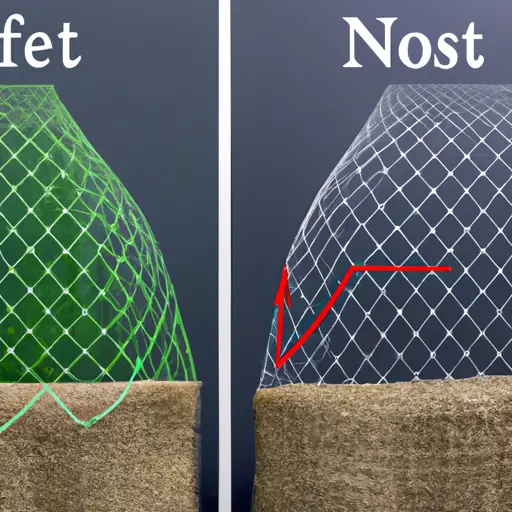

So what is the difference between net and gross profit

1. What is net profit?

Net profit is the amount of money left over after all expenses and taxes have been deducted from a company’s total revenue. It represents the total gain or loss for a business, as it takes into account both income and outgoings. Net profit can be an important indicator of a company’s financial health, as it reveals how efficiently it is managing its resources. Generally speaking, if net profit rises then this is seen to be good news for the firm in question.

2. What is gross profit?

Gross profit, also known as gross margin, is the difference between revenue generated from a product or service and its associated costs of production. It is the total income left over after subtracting all expenses related to product creation. Gross profit may include direct materials and labor, but it does not take into account any taxes or other overhead expenses. Gross profit serves as an indicator of how efficient a company’s operations are in terms of cost control and pricing strategies. Additionally, gross profit can be used to compare performance across different periods of time.

3. How are net and gross profits calculated differently?

Net profit is the earnings a company has remaining after subtracting all its expenses from its total revenue. This includes operating costs such as wages, employee benefits, rent and other overhead expenses related to running the business. Gross profit is calculated by subtracting the cost of goods sold (COGS) from total sales. COGS includes raw materials and direct labor costs associated with producing products for sale or providing services to customers. Net profits are typically lower than gross profits because they take into consideration additional non-production costs that can’t be deducted from gross profits; such as taxes, insurance premiums and interest payments on loans taken out by the company.

4. How do taxes affect the calculation of each type of profit?

Taxes are a major factor that can affect the calculation of each type of profit. For example, when calculating net income, taxes must be taken into account. If taxes are higher than expected, then the company’s net income will be lower than what was anticipated. Additionally, when calculating gross profit and operating profits, any expenses related to taxes need to be subtracted from the overall revenue number in order for accurate calculations to take place. It is important to note that even if a business has not actually paid its tax bill yet at the time of making these calculations, it still needs to include this amount as an expense since it represents money that needs to eventually be paid out by the company. Ultimately all types of profits are significantly impacted by taxes due to their importance in determining how much money is available after all expenses have been accounted for and thus how successful a business ultimately ends up being financially.

5. Do net and gross profits appear on a financial statement?

Yes, net and gross profits appear on a financial statement. Net profit is the total revenue generated from sales of goods or services less operating expenses such as cost of goods sold, wages and taxes. Gross profit appears in the income statement as the difference between total sales revenue and cost of goods sold. This amount reflects all costs related to producing and selling products or services before taking into account any other expenses incurred during operations like interest expense, general administrative costs and depreciation. Companies use these two figures to assess their overall profitability by comparing them to industry standards or previous periods’ performance.

6. Are there any other factors to consider when calculating net or gross profit?

Yes, there are other factors to consider when calculating net or gross profit. For example, cost of goods sold should be taken into account when determining net profit as this will be deducted from total sales revenue. Additionally, expenses such as marketing and advertising costs could also have an effect on your overall profitability. Furthermore, depreciation can also impact a company’s bottom line since it represents the reduction in value of assets over time; hence it must be factored into any calculations involving profits. Finally, income tax liabilities should always be considered during any assessment of profits due to its implications for overall financial performance.

7. Is there a difference in the way net and gross profits are reported for tax purposes?

Yes, there is a difference between the way net and gross profits are reported for tax purposes. Net profit is the amount remaining after all expenses have been deducted from total income, while gross profit is simply the amount of income received minus any direct costs associated with generating that revenue. For tax purposes, net profit is used to determine how much an individual or business owes in taxes, while gross profits are generally not included in calculations when determining taxable income. Additionally, deductions can be taken against net profits to reduce the overall taxable amount even further.

8. Does one type of profit provide more information than the other about a company’s performance ?

When it comes to measuring a company’s performance, both gross and net profit provide valuable information. Gross profit is the amount of money that a business makes after subtracting its cost of goods sold (COGS) from its revenue. Net profit, on the other hand, takes into account all expenses incurred by the business in order to generate sales—including administrative costs, taxes, interest payments etc.—making it an important metric for assessing profitability and cash flow. Net profit offers greater insight into how efficiently a business is operating since it reflects all operating costs associated with generating sales which can help investors better understand whether or not the company’s strategies are working. It also shows what portion of each sale goes toward covering overhead expenses as well as taxes and other liabilities such as loan payments or debts. In comparison, gross profit does not take into consideration these additional operational factors making it less informative when evaluating overall performance.

9. Does one type of profit have more impact on stock prices than the other ?

It depends on the company, industry and overall market conditions. Generally speaking though, short-term profits tend to have more of an immediate effect on stock prices because investors are often looking for quick returns. Long-term profits, on the other hand, can be more indicative of a company’s success over time since they indicate sustained performance across multiple quarters or years. Ultimately, stock prices reflect investor sentiment which is determined by both short- and long-term factors including earnings growth potential, operational efficiency and competitive position in the marketplace. Companies that demonstrate greater consistency in their financial performance are typically rewarded with higher valuations from investors who recognize the value of stability.

10. Are there different methods used to calculate each type of profitability ?

Yes, there are different methods used to calculate each type of profitability. Return on investment (ROI), for example, is a measure of the overall return an investor can expect from their portfolio or investments. It takes into account both capital gains and income generated by the portfolio over time. Net present value (NPV) looks at the expected future cash flows associated with a project or investment and determines its relative worth today based on those expectations. Internal rate of return (IRR) measures how much money an investor will earn from their initial investment in comparison to other potential investments they could have made instead. Finally, earnings before interest and taxes (EBIT) examines net profits after accounting for all expenses but before taking into consideration any interest payments that may be due. All four of these methods provide helpful insight into which projects may be more profitable than others when it comes to making financial decisions.